1. Create a new parts document by selecting the correct Branch, Department and Type of Sale.

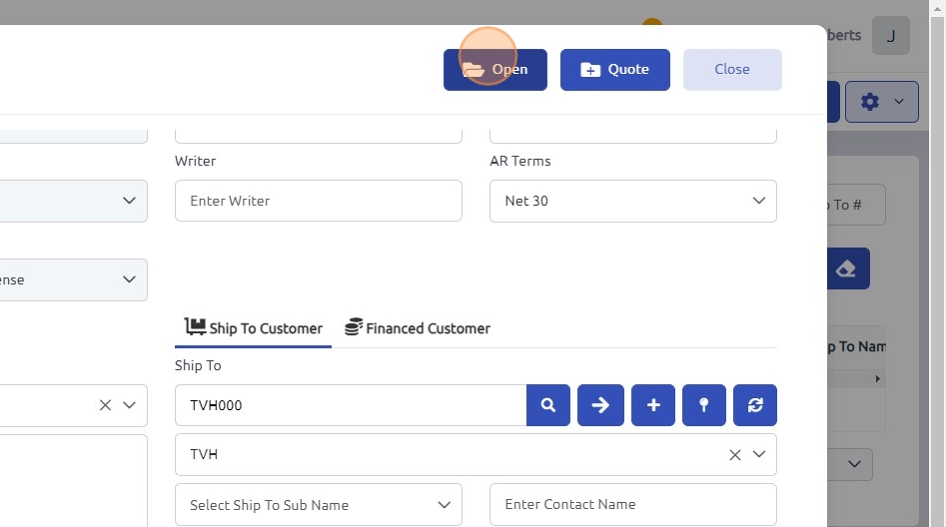

The vendor must be set up as a customer for return purposes, enter the Customer Number that corresponds to the vendor. If the vendor is not yet set up as a customer, you may need to create a new customer record for the vendor in the system, ensuring accurate vendor details are entered.

The Vendor customer profile would need to be non-taxable and would also need to have special parts pricing specified to default parts pricing to cost, with no markup.

2. Click "Open"

3. Enter all parts needing to be returned to the Vendor into the parts tab, ensuring quantities and costs are correct.

4. Click "Invoice" and follow standard invoicing procedures.

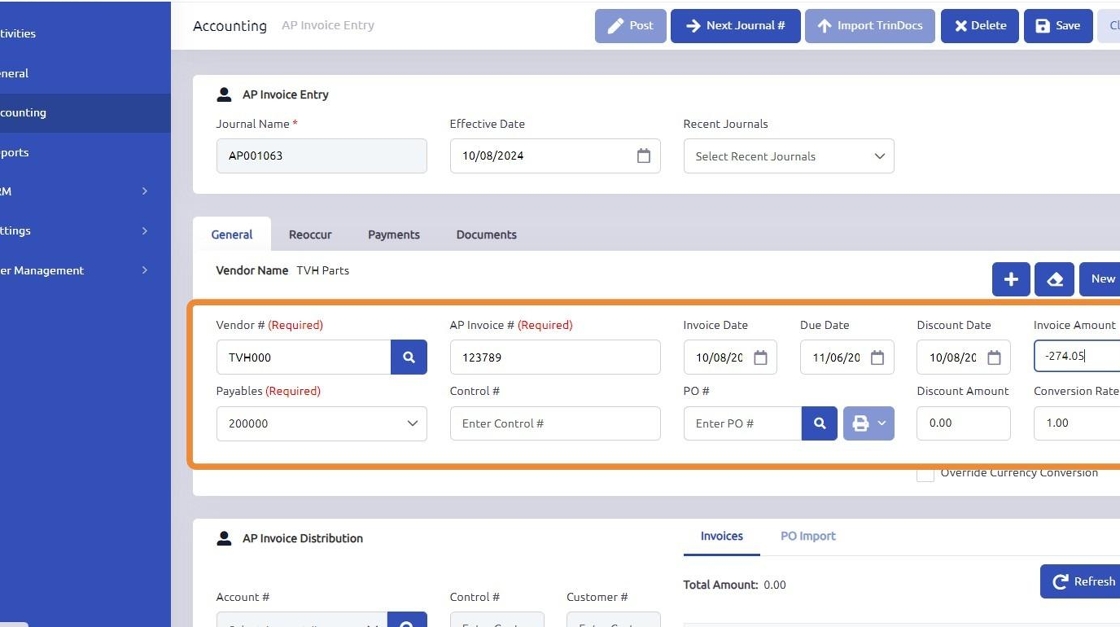

5. When your dealer receives a credit memo from a vendor, it should be entered into the AP Invoice program to record the credited amount and offset any lost funds.

Click "AP Invoice Entry"

6. Click "Add AP Invoice Entry"

7. Click "Next Journal #"

8. Click "Save".

9. Enter the Vendor number into the Vendor# field.

Enter the Vendor invoice/credit memo number into the AP Invoice # field.

Enter the Invoice Amount as the negative amount of the credit received.

10. Click "Add".

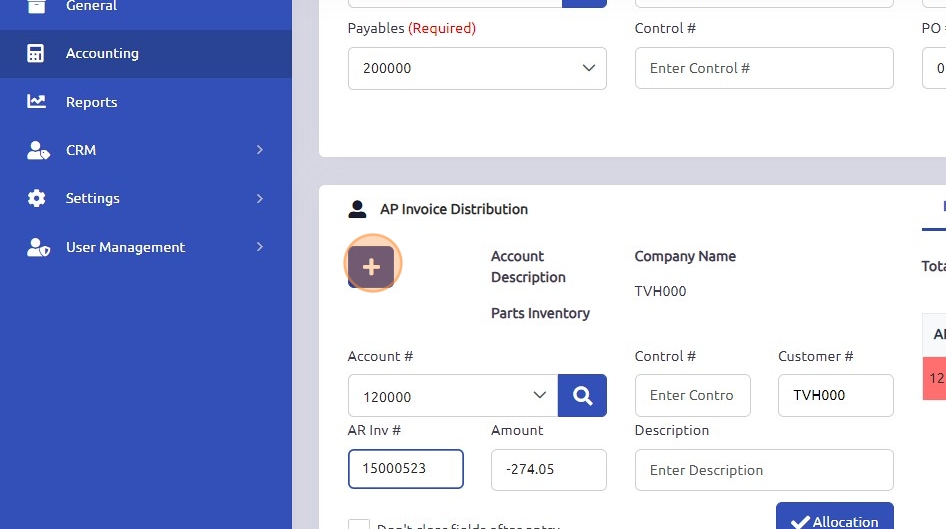

11. In the AP Invoice Distribution section enter or search for the Accounts Receivable account where the credited funds will be applied.

12. Click the "Customer #" field and enter the Vendors Customer number.

13. Click the "AR Inv #" field and enter the invoice number that was originally billed to the Vendor (see step 4) to ensure the credit is correctly applied to the invoice. Enter the amount of the original vendor invoice as a negative amount into the amount field.

NOTE: If the credit memo is less than the original cost incurred when the parts were purchased, the difference (lost funds) will need to be allocated to a separate account or written off as a loss. If there's a difference between the two amounts, the remaining positive balance will appear in the AP invoice distribution. The remaining positive balance must be applied to an internal account.

Example:

- Initial Invoice Amount: $600.00

- Vendor Credit Memo: -$500.00

In this case, the full -$600.00 must be added to the amount in the distribution to relieve the AR account, and the remaining balance of +100.00 (the difference between the credit and the original invoice) needs to be allocated to an expense account or written off as a loss.

14. Click "Add".

15. Click "Post".

16. Click "Yes".

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article